1.25 kk

Washington, D.C.

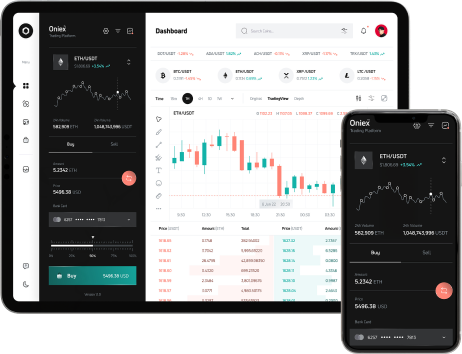

Sign Up

Create your free account using your email or social login. Verify your identity to comply with regulatory standards and unlock full trading features.

Deposit Funds

Choose from multiple funding options including: Bank Transfers Credit/Debit Cards E-Wallets Crypto Wallets All transactions are encrypted and secure.

Start Trading

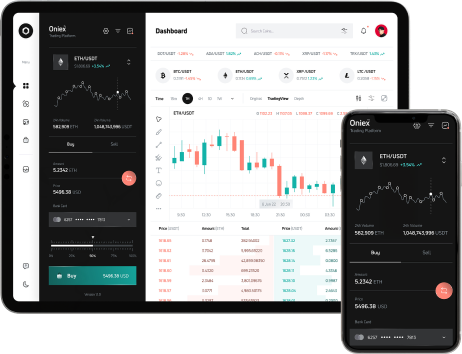

Use our platform to place your first trade. Choose your asset, analyze the chart, set your position, and execute with one click.

Market Spreads and Swaps

- Forex

- Cryto CFDs

- Share CFDs

- Commondities

- Spot Metals

- Energies

- Indices

Account Types

Basic Account

We offer flexible account options to suit your trading style and goals.

We’re a diverse team of developers, analysts, and customer success experts, all passionate about trading and innovation. With decades of combined experience, we’re here to help you grow your trading journey every step of the way.

- Minimum deposit: $100

- Access to all assets

- Standard spreads

- Email support

MT4/MT

We offer flexible account options to suit your trading style and goals.

We’re a diverse team of developers, analysts, and customer success experts, all passionate about trading and innovation. With decades of combined experience, we’re here to help you grow your trading journey every step of the way.

- Minimum deposit: $1,000

- Lower spreads

- Weekly market reports

- Webinars access

FXT Cpoy

We offer flexible account options to suit your trading style and goals.

We’re a diverse team of developers, analysts, and customer success experts, all passionate about trading and innovation. With decades of combined experience, we’re here to help you grow your trading journey every step of the way.

- Minimum deposit: $5,000

- Personal account manager

- Priority withdrawals

- Premium analytics

Types of Trading

Day Trading

Involves buying and selling assets within the same trading day.

Positions are not held overnight.

Requires fast decision-making and often uses technical analysis.

High risk, high potential reward.

Swing Trading

Positions are held for days to weeks.

Aims to capture short-term trends.

Involves both technical and fundamental analysis.

Less stressful than day trading but still active.

Scalping

A form of ultra-short-term trading.

Traders aim to make small profits on very short price movements.

Requires constant monitoring and fast execution.

Position Trading

Long-term trading, often based on macroeconomic trends.

Similar to investing, but with active entry/exit management.

Lower stress, but requires patience and research.

Client World Wide

Satisfied Clients

Money Invested

Expert Traders

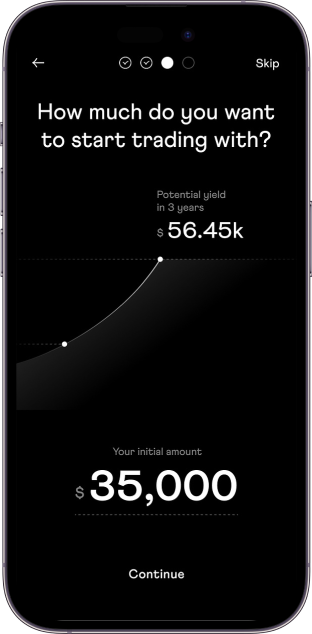

How to Start Trading

Educate Yourself

Start with the basics: read, watch videos, or take courses. Understand the risks involved and the instruments available.

Choose a Reliable Broker

Pick a regulated broker with a good reputation and platform. Compare fees, asset availability, and customer service.

Open a Trading Account

Submit your personal details and complete verification (KYC). This is required for regulatory compliance.

What is Financial Trading?

The goal is simple: Buy low and sell high (or, in some cases, sell high and buy back lower—a practice called short selling). Unlike investing, which is typically long-term and focused on company value or dividends, trading is usually short to medium term, driven by price movements.

1 milion+

XTB Group Clients

5 milion+

Leverage and Margin

1+

Years on the market

FSC

Regulated by authorities

Latest News Update

Money Trading: What It Is, How It Works, and How You Can Get Started

Have you ever heard people say they "trade for a living" or “made money in the markets” and wondered what that actually means? Money trading refers to the act of buying and selling financial assets—like currencies, stocks, or cryptocurrencies—to make a profit. It’s not gambling, and it’s not magic. It’s a skill. Like any other skill, it requires knowledge, patience, and practice. In this blog, we’ll break down the essentials of money trading, how it works, and how you can get started—even if you’re completely new.

What is Money Trading?

Money trading simply means exchanging one financial asset for another with the goal of making money from price changes. For example: Buying a stock at $50 and selling it later for $60. Trading EUR/USD when the euro gains strength against the U.S. dollar. Buying Bitcoin before a price rally and selling after it increases in value. This activity happens every day on financial markets—huge platforms where people around the world trade everything from currencies to commodities to tech stocks.

Who Trades Money?

There are different types of money traders: Retail traders: Regular people like you and me trading from a computer or phone. Institutional traders: Banks, hedge funds, and financial firms trading huge amounts. Automated traders: Bots and algorithms that place trades based on programmed rules. Retail trading has become increasingly popular thanks to online platforms that make it easy and affordable to get started.